Bitcoin is a cryptocurrency and a payment system invented by an unidentified programmer, or group of programmers, under the name of Satoshi Nakamoto. Bitcoin was introduced on 31 October 2008 to a cryptography mailing list, and released as open-source software in 2009. There have been various claims and speculation concerning the identity of Nakamoto, none of which are confirmed. The system is peer-to-peer and transactions take place between users directly, without an intermediary.4These transactions are verified by network nodes and recorded in a public distributed ledger called the blockchain, which uses bitcoin as its unit of account. Since the system works without a central repository or single administrator, the U.S. Treasury categorizes bitcoin as a decentralized virtual currency. Bitcoin is often called the first cryptocurrency, although prior systems existed and it is more correctly described as the first decentralized digital currency. Bitcoin is the largest of its kind in terms of total market value.

Bitcoins are created as a reward in a competition in which users

offer their computing power to verify and record bitcoin transactions

into the blockchain. This activity is referred to as mining and successful miners are rewarded with transaction fees and newly created bitcoins. Besides being obtained by mining, bitcoins can be exchanged for other currencies, products, and services. When sending bitcoins, users can pay an optional transaction fee to the miners. This may expedite the transaction being confirmed.

In February 2015, the number of merchants accepting bitcoin for products and services passed 100,000. Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees in the range from 0% to less than 2%.

Despite the fourfold increase in the number of merchants accepting

bitcoin in 2014, the cryptocurrency did not have much momentum in retail

transactions. The European Banking Authority and other sources have warned that bitcoin users are not protected by refund rights or chargebacks. The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and media.Criminal activities are primarily focused on darknet markets

and theft, though officials in countries such as the United States also

recognize that bitcoin can provide legitimate financial services.

Bitcoin currency rate in Bangladesh ......

There is no uniform convention for bitcoin capitalization. Some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, to refer to the unit of account. The Wall Street Journal, The Chronicle of Higher Education, and the Oxford English Dictionary advocate use of lowercase bitcoin in all cases. This article follows the latter convention.

.

Small amounts of bitcoin used as alternative units are millibitcoin

(mBTC), microbitcoin (µBTC), and satoshi. Named in homage to bitcoin's

creator, a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoin, one hundred millionth of a bitcoin. A millibitcoin equals to 0.001 bitcoin, one thousandth of bitcoin. One microbitcoin equals to 0.000001 bitcoin, one millionth of a bitcoin. A microbitcoin is sometimes referred to as a bit.

.

Small amounts of bitcoin used as alternative units are millibitcoin

(mBTC), microbitcoin (µBTC), and satoshi. Named in homage to bitcoin's

creator, a satoshi is the smallest amount within bitcoin representing 0.00000001 bitcoin, one hundred millionth of a bitcoin. A millibitcoin equals to 0.001 bitcoin, one thousandth of bitcoin. One microbitcoin equals to 0.000001 bitcoin, one millionth of a bitcoin. A microbitcoin is sometimes referred to as a bit.

A proposal was submitted to the Unicode Consortium in October 2015 to add a codepoint for the symbol. It is in the pipeline for position 20BF (₿) in the Currency Symbols block.

Ownership of bitcoins implies that a user can spend bitcoins associated with a specific address. To do so, a payer must digitally sign the transaction using the corresponding private key.

Without knowledge of the private key, the transaction cannot be signed

and bitcoins cannot be spent. The network verifies the signature using

the public key.

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; the coins are then unusable, and thus effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.

A transaction must have one or more inputs.

For the transaction to be valid, every input must be an unspent output

of a previous transaction. Every input must be digitally signed. The use

of multiple inputs corresponds to the use of multiple coins in a cash

transaction. A transaction can also have multiple outputs, allowing one

to make multiple payments in one go. A transaction output can be

specified as an arbitrary multiple of satoshi. As in a cash transaction,

the sum of inputs (coins used to pay) can exceed the intended sum of

payments. In such a case, an additional output is used, returning the

change back to the payer. Any input satoshis not accounted for in the transaction outputs become the transaction fee.

Mining is a record-keeping service.

Miners keep the blockchain consistent, complete, and unalterable by

repeatedly verifying and collecting newly broadcast transactions into a

new group of transactions called a block. Each block contains a cryptographic hash of the previous block, using the SHA-256 hashing algorithm, which links it to the previous block thus giving the blockchain its name.

In order to be accepted by the rest of the network, a new block must contain a so-called proof-of-work. The proof-of-work requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target. This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is 0, 1, 2, 3, ...) before meeting the difficulty target.

Every 2016 blocks (approximately 14 days), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[8]:ch. 8

Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted. As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.

The rewards of mining have led to ever-more-specialized technology being utilized. The most efficient mining hardware makes use of custom designed application-specific integrated circuits, which outperform general-purpose CPUs while using less power. As of 2015, a miner who is not using purpose-built hardware is unlikely to earn enough to cover the cost of the electricity used in their efforts, even if they are a member of a pool.

Bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free. Journalist Matt O'Brien has pointed out that pollution connected with electricity usage in "energy-intensive" bitcoin mining are "paying less than they should" due to "environmental spillovers on everyone else, or what economists call negative externalities." According to O'Brien, bitcoin is not lowering costs, but "shifting them" into pollution costs.

The successful miner finding the new block is rewarded with newly created bitcoins and transaction fees.[63] As of 9 July 2016,

the reward amounted to 12.5 newly created bitcoins per block added to

the blockchain. To claim the reward, a special transaction called a coinbase is included with the processed payments.[ All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol

specifies that the reward for adding a block will be halved every

210,000 blocks (approximately every four years). Eventually, the reward

will decrease to zero, and the limit of 21 million bitcoins[note 7] will be reached c. 2140; the record keeping will then be rewarded by transaction fees solely.

In other words, bitcoin's inventor Nakamoto set a monetary policy at the start of the bitcoin concept that there would only ever be 21 million bitcoins in total, their numbers being released roughly every ten minutes, and the rate at which they would be generated would drop by half every four years until all were in circulation.

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold or store bitcoins,

due to the nature of the system, bitcoins are inseparable from the

blockchain transaction ledger. A better way to describe a wallet is

something that "stores the digital credentials for your bitcoin

holdings" and allows you to access (and spend) them. Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated. At its most basic, a wallet is a collection of these keys.

There are several types of wallets. Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership. Software wallets can be split further in two categories: full clients and lightweight clients.

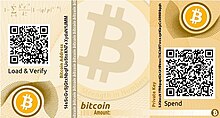

Physical wallets also exist and are more secure, as they store the credentials necessary to spend bitcoins offline.[68] Examples combine a novelty coin with these credentials printed on metal, Others are simply paper printouts. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.

To heighten financial privacy, a new bitcoin address can be generated for each transaction. For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys. Additionally, "mixing" and CoinJoin services aggregate multiple users' coins and output them to fresh addresses to increase privacy. Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs.

According to Dan Blystone, "Ultimately, bitcoin resembles cash as much as it does credit cards."

Bitcoin currency rate in Bangladesh ......

Etymology and orthography

The word bitcoin occurred in the white paper that defined bitcoin published in 2008. It is a compound of the words bit and coin. The white paper frequently uses the shorter coin.There is no uniform convention for bitcoin capitalization. Some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, to refer to the unit of account. The Wall Street Journal, The Chronicle of Higher Education, and the Oxford English Dictionary advocate use of lowercase bitcoin in all cases. This article follows the latter convention.

Design

Blockchain

The blockchain is a public ledger that records bitcoin transactions. A novel solution accomplishes this without any trusted central authority: maintenance of the blockchain is performed by a network of communicating nodes running bitcoin software. Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications. Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. The blockchain is a distributed database – to achieve independent verification of the chain of ownership of any and every bitcoin (amount), each network node stores its own copy of the blockchain. Approximately six times per hour, a new group of accepted transactions, a block, is created, added to the blockchain, and quickly published to all nodes. This allows bitcoin software to determine when a particular bitcoin amount has been spent, which is necessary in order to prevent double-spending in an environment without central oversight. Whereas a conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.Units

The unit of account of the bitcoin system is bitcoin. As of 2014, symbols used to represent bitcoin are BTC, XBT, andA proposal was submitted to the Unicode Consortium in October 2015 to add a codepoint for the symbol. It is in the pipeline for position 20BF (₿) in the Currency Symbols block.

Ownership

Simplified chain of ownership. In reality, a transaction can have more than one input and more than one output.

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership; the coins are then unusable, and thus effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.

Transactions

Mining

Relative mining difficulty, the scale is logarithmic.

A mining farm in Iceland

In order to be accepted by the rest of the network, a new block must contain a so-called proof-of-work. The proof-of-work requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target. This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is 0, 1, 2, 3, ...) before meeting the difficulty target.

Every 2016 blocks (approximately 14 days), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[8]:ch. 8

Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted. As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.

Practicalities

It has become common for miners to join mining pools, which combine the computational resources of their members in order to increase the frequency of generating new blocks. The reward for each block is then split proportionately among the members, creating a more predictable stream of income for each miner without necessarily changing their long-term average income, although a fee may be charged for the service.The rewards of mining have led to ever-more-specialized technology being utilized. The most efficient mining hardware makes use of custom designed application-specific integrated circuits, which outperform general-purpose CPUs while using less power. As of 2015, a miner who is not using purpose-built hardware is unlikely to earn enough to cover the cost of the electricity used in their efforts, even if they are a member of a pool.

Energy consumption

In 2013, Mark Gimein estimated electricity use to be about 982 megawatt-hours a day, which could be used to power roughly 31,000 US homes. In 2014, Karl J. O'Dwyer and David Malone estimated that specialized computers mining bitcoins required 0.1 to 10 GW of power. As of 2015, The Economist estimated that even if all miners used modern facilities, the combined electricity consumption would be 1.46 terawatt-hours per year—equal to the consumption of about 135,000 American homes.Bitcoin miners have set up in places like Iceland where geothermal energy is cheap and cooling Arctic air is free. Journalist Matt O'Brien has pointed out that pollution connected with electricity usage in "energy-intensive" bitcoin mining are "paying less than they should" due to "environmental spillovers on everyone else, or what economists call negative externalities." According to O'Brien, bitcoin is not lowering costs, but "shifting them" into pollution costs.

Supply

Total bitcoins in circulation.

In other words, bitcoin's inventor Nakamoto set a monetary policy at the start of the bitcoin concept that there would only ever be 21 million bitcoins in total, their numbers being released roughly every ten minutes, and the rate at which they would be generated would drop by half every four years until all were in circulation.

Transaction fees

Paying a transaction fee is optional.[29] Miners can choose which transactions to process[29] and prioritize those that pay higher fees. Fees are based on the storage size of the transaction generated, which in turn is dependent on the number of inputs used to create the transaction. Furthermore, priority is given to older unspent inputs.[8]:ch. 8Wallets

Electrum bitcoin wallet

Bitcoin paper wallet generated at bitaddress.org

Trezor hardware wallet

There are several types of wallets. Software wallets connect to the network and allow spending bitcoins in addition to holding the credentials that prove ownership. Software wallets can be split further in two categories: full clients and lightweight clients.

- Full clients verify transactions directly on a local copy of the blockchain (over 80 GB as of November 2016). Because of its size / complexity, the entire blockchain is not suitable for all computing devices.

- Lightweight clients on the other hand consult a full client to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV). This makes lightweight clients much faster to setup and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet however, the user must trust the server to a certain degree. When using a lightweight client, the server can not steal bitcoins, but it can report faulty values back to the user. With both types of software wallets, the users are responsible for keeping their private keys in a secure place.

Physical wallets also exist and are more secure, as they store the credentials necessary to spend bitcoins offline.[68] Examples combine a novelty coin with these credentials printed on metal, Others are simply paper printouts. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions.

Reference implementation

The first wallet program was released in 2009 by Satoshi Nakamoto as open-source code. Sometimes referred to as the "Satoshi client," this is also known as the reference client because it serves to define the bitcoin protocol and acts as a standard for other implementations. In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as Bitcoin-Qt. After the release of version 0.9, the software bundle was renamed Bitcoin Core to distinguish itself from the network. Today, other forks of Bitcoin Core exist such as Bitcoin XT, Bitcoin Classic, and Bitcoin Unlimited.Privacy

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses. Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.To heighten financial privacy, a new bitcoin address can be generated for each transaction. For example, hierarchical deterministic wallets generate pseudorandom "rolling addresses" for every transaction from a single seed, while only requiring a single passphrase to be remembered to recover all corresponding private keys. Additionally, "mixing" and CoinJoin services aggregate multiple users' coins and output them to fresh addresses to increase privacy. Researchers at Stanford University and Concordia University have also shown that bitcoin exchanges and other entities can prove assets, liabilities, and solvency without revealing their addresses using zero-knowledge proofs.

According to Dan Blystone, "Ultimately, bitcoin resembles cash as much as it does credit cards."

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Bitcoin News

ReplyDeleteThis is arguably the largest resource for all things bitcoin. The news sections cover the latest insights from the best writers in the fintech sector. In addition to this, the site is filled with numerous tools that help investors make informed decisions. What I like about the convenience of finding all you need in the same platform.

Bitcoin News

ReplyDeleteThis is arguably the largest resource for all things bitcoin. The news sections cover the latest insights from the best writers in the fintech sector. In addition to this, the site is filled with numerous tools that help investors make informed decisions. What I like about the convenience of finding all you need in the same platform.

CoinDesk

ReplyDeleteThis is one of the top new sources for bitcoin enthusiasts. In fact, it is the largest bitcoin news media platform in the world. The site is packed with reports and tools that break down the trends and patterns in cryptocurrency. I recommend checking out the reports on the research page.

CoinDesk

ReplyDeleteThis is one of the top new sources for bitcoin enthusiasts. In fact, it is the largest bitcoin news media platform in the world. The site is packed with reports and tools that break down the trends and patterns in cryptocurrency. I recommend checking out the reports on the research page.

CoinDesk

ReplyDeleteThis is one of the top new sources for bitcoin enthusiasts. In fact, it is the largest bitcoin news media platform in the world. The site is packed with reports and tools that break down the trends and patterns in cryptocurrency. I recommend checking out the reports on the research page.

Bitcoin News

ReplyDeleteThis is arguably the largest resource for all things bitcoin. The news sections cover the latest insights from the best writers in the fintech sector. In addition to this, the site is filled with numerous tools that help investors make informed decisions. What I like about the convenience of finding all you need in the same platform.

Bitcoin News

ReplyDeleteThis is arguably the largest resource for all things bitcoin. The news sections cover the latest insights from the best writers in the fintech sector. In addition to this, the site is filled with numerous tools that help investors make informed decisions. What I like about the convenience of finding all you need in the same platform.

CoinDesk

ReplyDeleteThis is one of the top new sources for bitcoin enthusiasts. In fact, it is the largest bitcoin news media platform in the world. The site is packed with reports and tools that break down the trends and patterns in cryptocurrency. I recommend checking out the reports on the research page.

Bitcoin News

ReplyDeleteThis is arguably the largest resource for all things bitcoin. The news sections cover the latest insights from the best writers in the fintech sector. In addition to this, the site is filled with numerous tools that help investors make informed decisions. What I like about the convenience of finding all you need in the same platform.

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!

Thank you for sharing this information.

ReplyDeleteCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!!